Undoubtedly, the most high-profile payment card in the world is often considered the American Express Centurion Card, commonly known as the “Amex Black Card.” However, true exclusivity goes beyond mere recognition; it embodies a luxury and distinction that few can access. In this realm, the Insignia Jewellery Card stands unmatched.

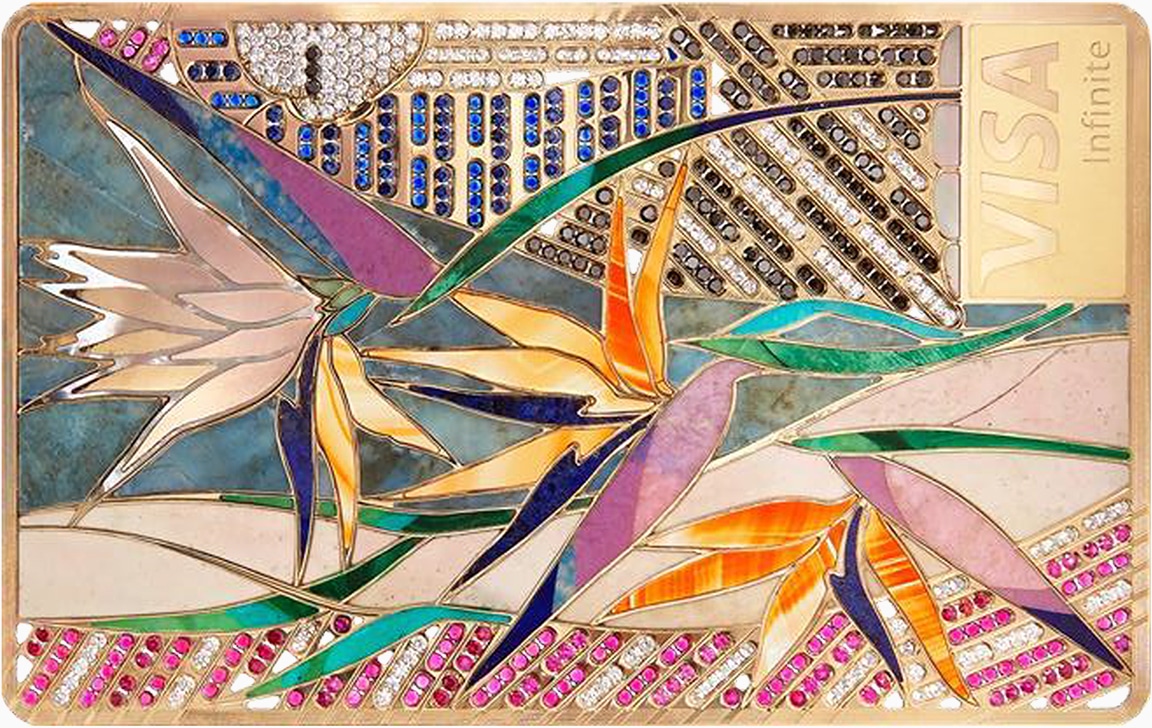

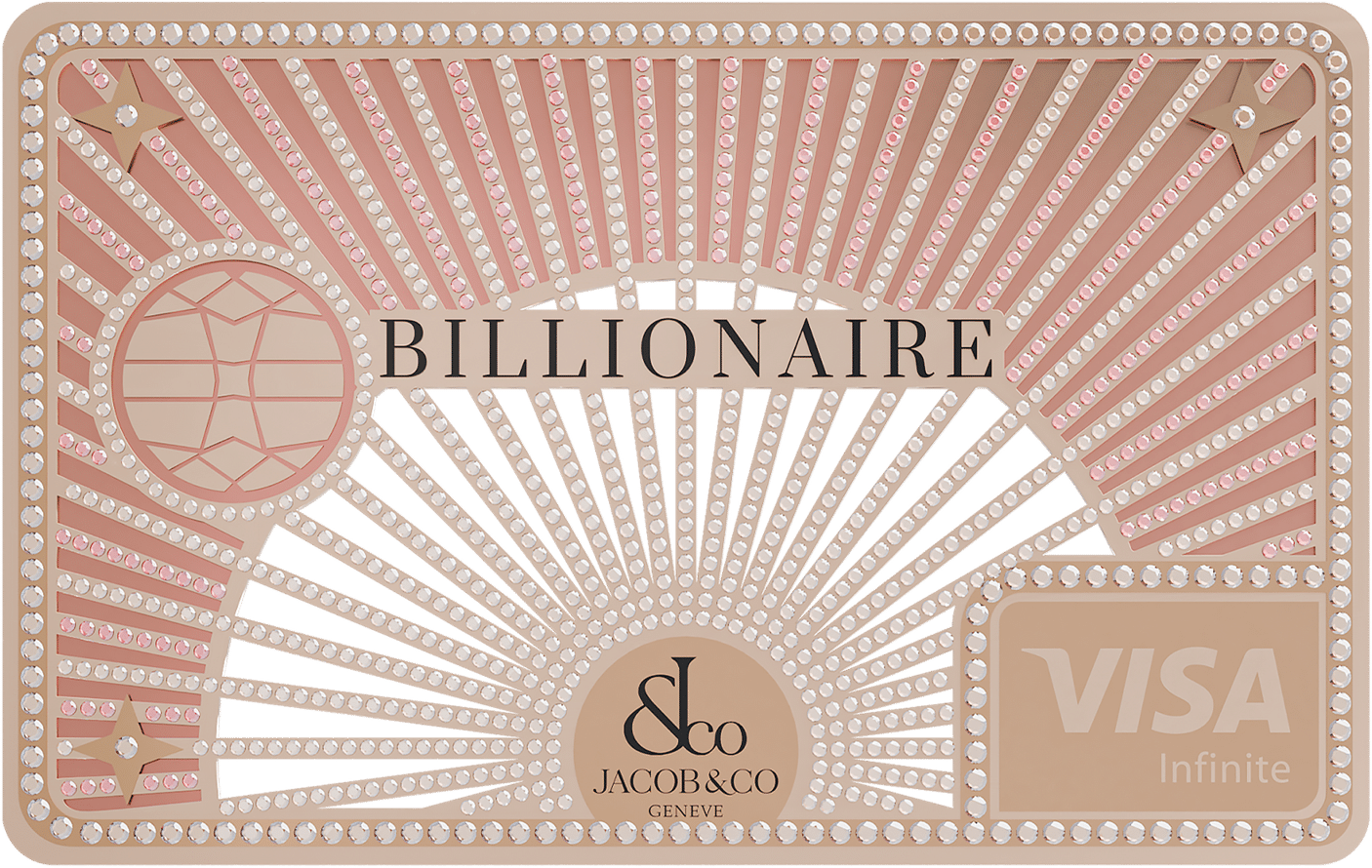

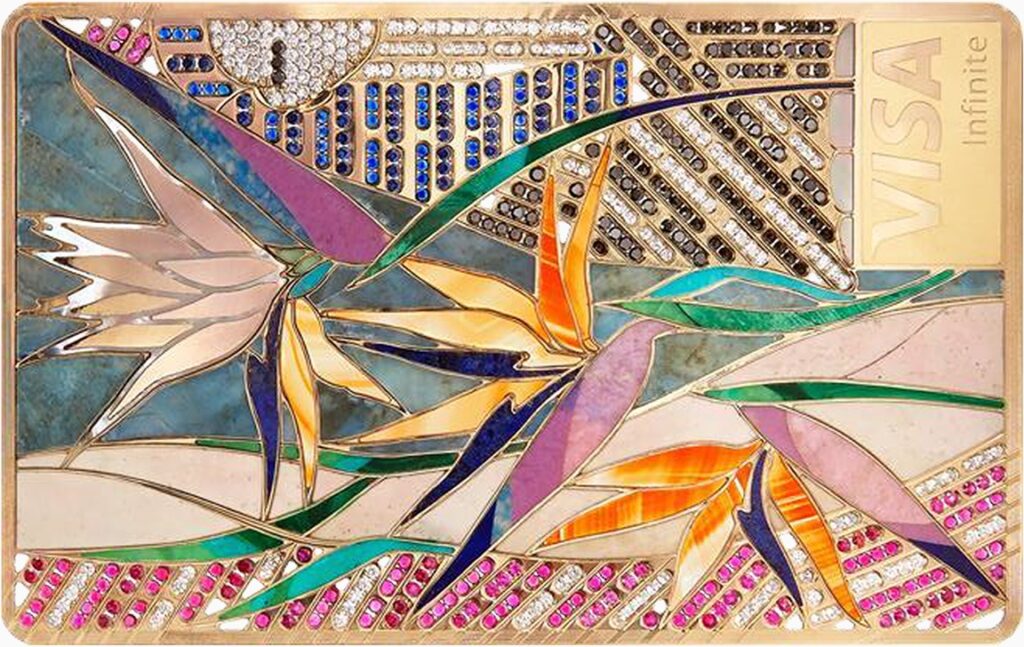

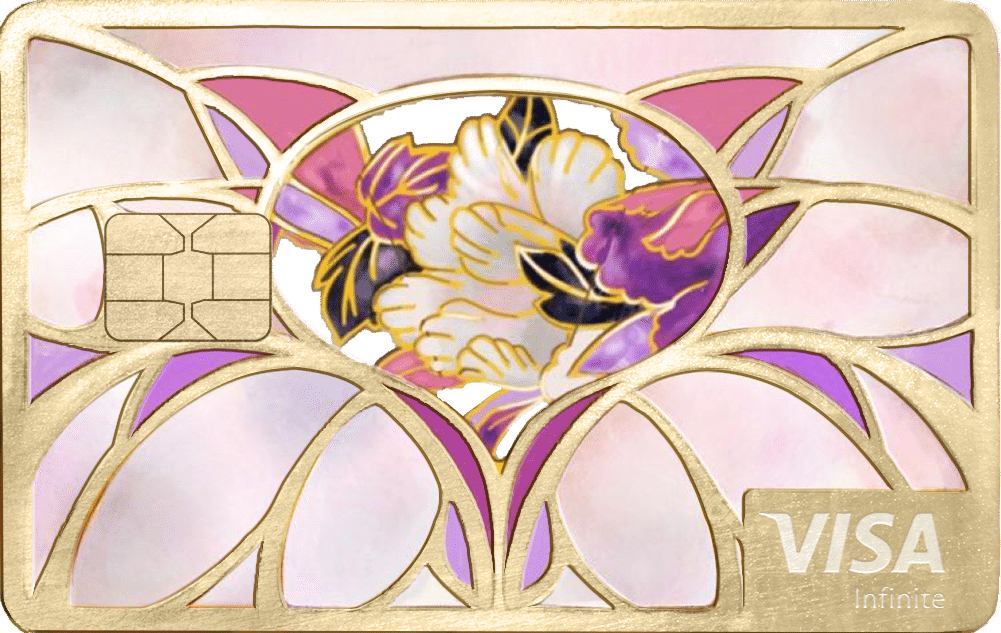

Crafted with a solid gold foundation, each Insignia Jewellery Card is a unique masterpiece created by skilled jewellery artisans and craftsmen. These cards are adorned with exquisite materials and precious jewels, such as Mother of Pearl, champagne diamonds, rubies, sapphires, and emeralds, ensuring no two cards are alike. This meticulous attention to detail makes each card a unique symbol of wealth and status.

Yet, the true allure of the Insignia Jewellery Card lies beyond its stunning physical appearance. It is renowned for its invitation-only application process, ensuring that only the most discerning individuals gain access.

Cardholders enjoy exceptional lifestyle services, including value-added perks with the world’s leading luxury properties, a dedicated personal assistant available 24/7/365, and its own private jets service and app that offers discounts on private jets while also assisting members in buying, owning, storing, and maintaining their own private jet.

The card also offers a robust loyalty rewards programme, allowing members to redeem points earned on premium brand goods and services. Additionally, cardholders receive exclusive access to private, behind-closed-doors events that are inaccessible to others. This level of service and attention to detail elevates the Insignia Jewellery Card to a league of its own, epitomising luxury and exclusivity in the payment card industry.

The Insignia Jewellery Card is not just a payment method; it is the ultimate status symbol, a gateway to a world of unparalleled luxury, and a testament to the pinnacle of exclusivity.

How to get exclusive credit cards

Securing an exclusive credit card typically requires a combination of a high credit score, substantial income, and an existing relationship with the issuer. These cards often come with high annual fees but provide premium benefits such as luxury travel perks, personal concierge services, and access to exclusive events. Interested applicants should maintain excellent financial health, frequently use premium cards, and sometimes await an invitation from the issuer.

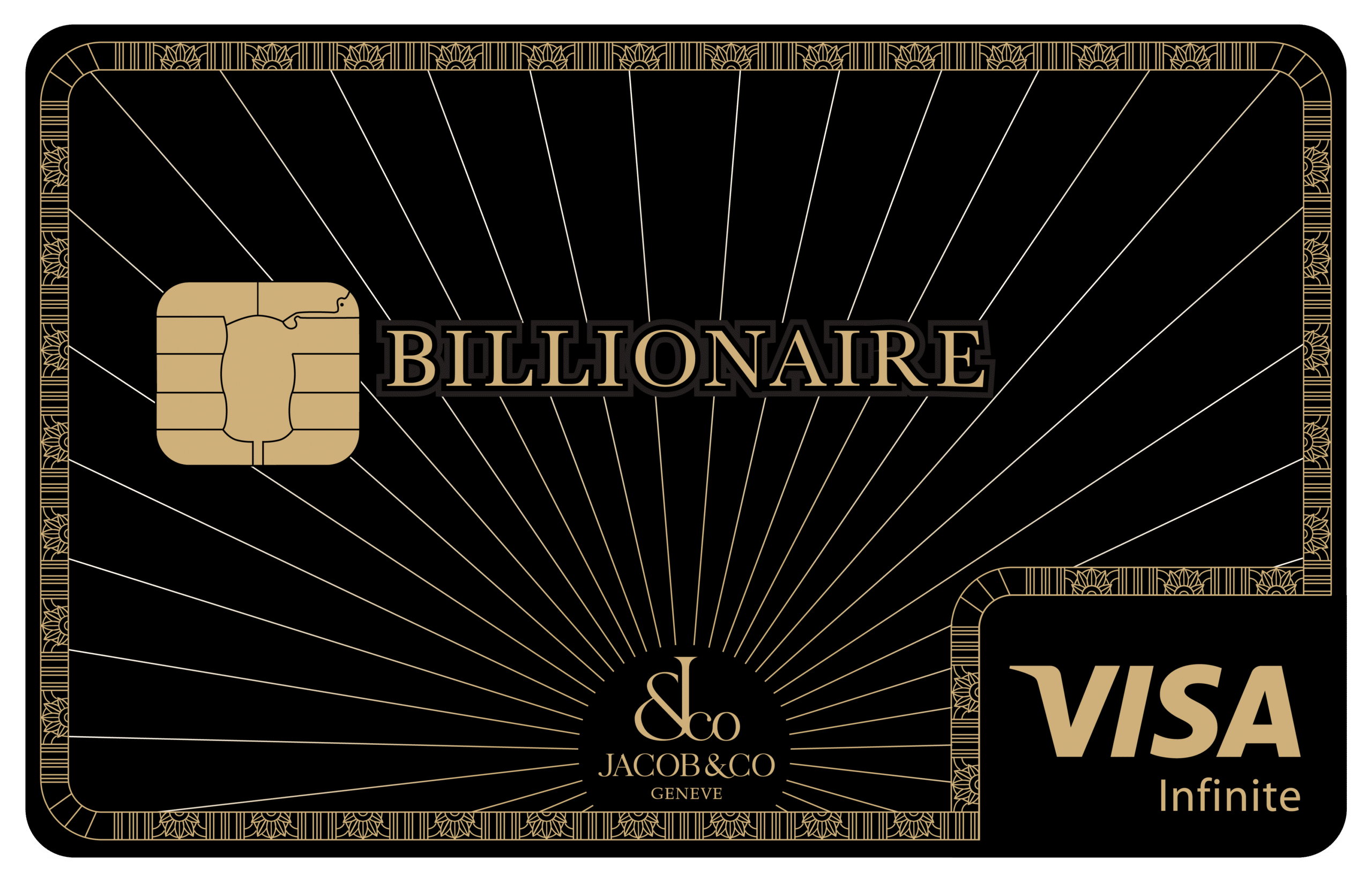

Exclusive credit cards that require an invitation

- American Express Centurion Card (Black Card)

- J.P. Morgan Reserve Card

- Coutts World Silk Card

- Dubai First Royale Mastercard

These cards are reserved for the elite, requiring excellent credit and an invitation based on your financial standing and spending patterns.

Premium credit cards that you can apply for

- The Platinum Card from American Express

- Chase Sapphire Reserve

- Capital One Venture X Rewards Credit Card

- Mastercard Gold Card

- Mastercard Black Card

These cards are accessible through direct application, offering high-end benefits and services.

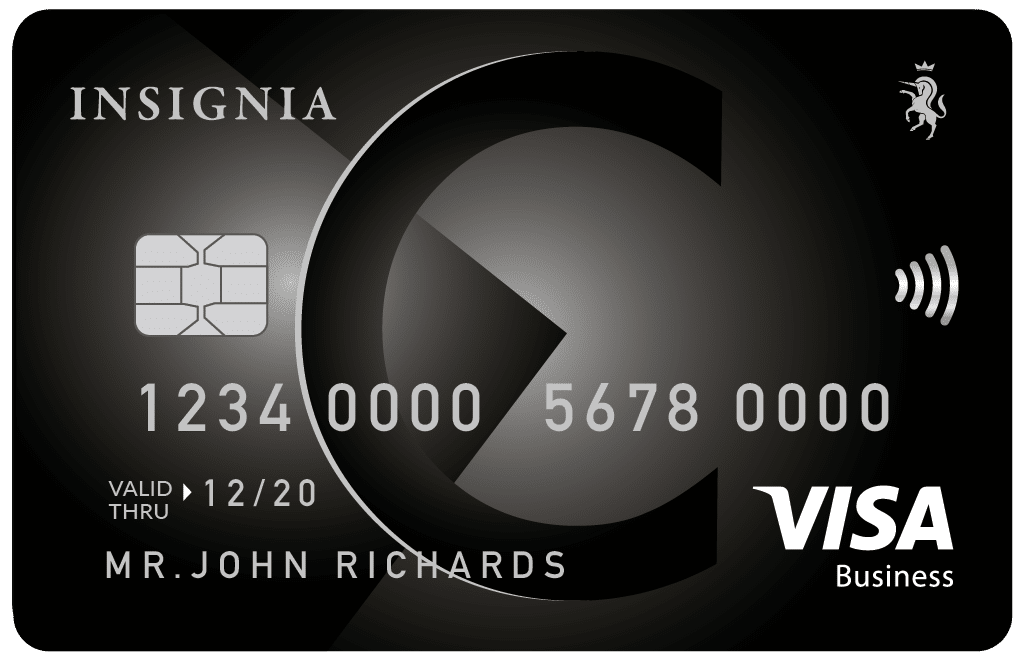

The Insignia Jewellery Card by Insignia

Welcome Bonus

The Jewellery Card by Insignia does not typically offer a welcome bonus. It focuses on bespoke services and luxury experiences tailored to the cardholder’s preferences.

Annual Fee

The annual fee for the Jewellery Card by Insignia is not publicly disclosed, reflecting its exclusive nature and the customised services it provides.

Regular APR

This card usually operates on a customised APR, which varies according to the cardholder’s financial profile and usage patterns.

Credit Score

A credit score of 800+ is typically required, along with significant wealth and an existing high-profile banking relationship.

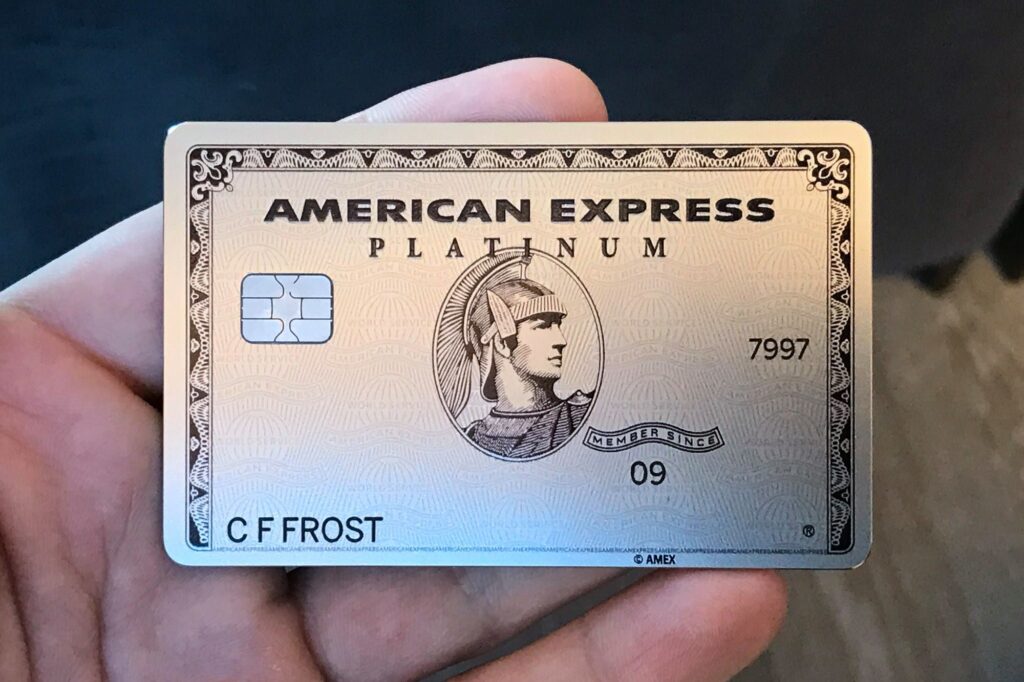

The Platinum Card from American Express

Welcome Bonus

Earn 100,000 Membership Rewards points after spending $6,000 on purchases in the first six months.

Annual Fee

$695 annually.

Regular APR

This card has a variable APR based on your creditworthiness and other factors, typically starting around 15.99%.

Credit Score

A credit score of 700 or higher is recommended.

Capital One Venture X Rewards Credit Card

Welcome Bonus

Earn 100,000 bonus miles after spending $10,000 on purchases in the first six months.

Annual Fee

$395 annually.

Regular APR

The variable APR ranges from 16.99% to 23.99%, depending on your creditworthiness.

Credit Score

A credit score of 720 or higher is recommended.

Chase Sapphire Reserve

Welcome Bonus

Earn 60,000 bonus points after spending $4,000 on purchases in the first three months.

Annual Fee

$550 annually.

Regular APR

The variable APR ranges from 16.99% to 23.99%, based on creditworthiness.

Credit Score

A credit score of 750 or higher is typically required.

Mastercard Gold Card

Welcome Bonus

The Mastercard Gold Card does not typically offer a welcome bonus, focusing on long-term value and benefits.

Annual Fee

$995 annually.

Regular APR

The variable APR is around 14.99%.

Credit Score

A credit score of 700 or higher is recommended.

Mastercard Black Card

Welcome Bonus

The Mastercard Black Card does not usually offer a traditional welcome bonus; instead, it emphasises luxury travel benefits and exclusive experiences.

Annual Fee

$495 annually.

Regular APR

The variable APR is around 14.99%.

Credit Score

A credit score of 700 or higher is recommended.

Is an exclusive credit card right for me?

Exclusive credit cards are ideal for individuals who frequently travel, enjoy luxury perks, and have a high disposable income. They offer extensive benefits such as concierge services, travel credits, and access to exclusive events. However, the high annual fees and spending requirements mean they are best suited for those who can fully utilise their premium features. Assess your spending habits, financial stability, and the value you place on luxury services before deciding.

FAQs about exclusive credit cards

What is the most exclusive credit card in the world?

The American Express Centurion Card, commonly known as the “Amex Black Card,” is often regarded as the most popular credit card in the world due to its invitation-only policy and extensive luxury benefits.

Which credit card is the most prestigious?

The Insignia Jewellery Card is considered the most prestigious due to its bespoke design, crafted with precious materials by skilled artisans. It offers unparalleled luxury services, including a dedicated personal assistant, exclusive events, and a unique private jet service, making it the ultimate symbol of wealth and exclusivity.

What credit card do millionaires use?

Many millionaires use the American Express Centurion Card, J.P. Morgan Reserve Card, the Insignia Jewellery Card, and other high-end, invitation-only cards that provide extensive travel perks and personalised services.

What is the most expensive type of credit card?

The American Express Centurion Card is among the most expensive, with a high initiation fee and annual fee, reflecting its premium services.

What annual fee do luxurious credit cards charge?

Luxurious credit cards charge annual fees ranging from $450 to over $5,000, depending on the card and the level of benefits provided.

What makes a credit card exclusive?

A credit card becomes exclusive through invitation-only application processes, high annual fees, and offering premium benefits such as luxury travel services, concierge support, and access to elite events. These cards are tailored to high-net-worth individuals seeking unparalleled perks and personalised services.