Call it the “super credit card,” the “black card,” or the “key to a kingdom of luxury and extravagance”—this year marks the 25th anniversary of the premium payment card concept. Over the past quarter-century, these cards have evolved from simple financial tools into symbols of opulence and status. Today, we explore the fascinating journey of the premium payment card and how it has become an indispensable accessory for those who value prestige and exclusivity. Discover the history, benefits, and allure that make premium payment cards a must-have for the discerning individual.

The Birth of a Legend: The Mythical “Black Card”

The story begins with a rumour. In the late 20th century, tales circulated among the elite about a mysterious “black card” – a credit card so exclusive that it could only be obtained by invitation. This card was said to offer unparalleled perks, like unlimited spending power and access to the most luxurious experiences money could buy.

While the “black card” was initially a figment of imagination, it wasn’t long before American Express saw an opportunity to bring the myth to life. 1999, they launched the Centurion Card, which is famously known as the “black card.” This card wasn’t just a financial product but a status symbol, an invitation to join a club reserved for the world’s wealthiest individuals.

The Rise of Celebrity Endorsements

The introduction of the Centurion Card coincided perfectly with the rise of celebrity culture. Icons like Jay-Z, who rapped about his black card, and Kim Kardashian, who flaunted hers on social media, turned the card into a pop culture phenomenon. These endorsements fueled the card’s allure, making it the ultimate accessory for the rich and famous.

The Evolution of Premium Payment Cards

Today, the landscape of premium payment cards has evolved far beyond the black card. Modern premium cards offer many benefits tailored to the needs of ultra-high-net-worth individuals (UHNWIs) and C-level executives. These cards blend luxury and utility, integrating advanced technology and personalised services.

Personalised Concierge Services: Imagine having a personal assistant available 24/7 to handle your every request, from booking last-minute flights to securing a table at a fully-booked Michelin-starred restaurant. Premium cards offer concierge services catering to your every whim, ensuring your lifestyle remains as smooth and luxurious as possible.

Exclusive Events and Experiences: Holders of premium cards gain access to exclusive events, from private concerts to VIP parties. For instance, a premium payment cardholder might receive an invitation to an intimate dinner with a world-renowned chef or front-row seats at a fashion show.

Practical Benefits: These cards are not all about indulgence. They also have practical perks like purchase protection, travel insurance, and airport lounge access. For example, if you buy a pricey gadget and it gets damaged, your card’s purchase protection might cover the cost of repairs or replacement.

Emerging Trends in Premium Payment Cards

The premium payment card industry continues to innovate, adapting to its affluent clientele’s changing needs and preferences. Here are some exciting trends:

Innovative Partnerships: Card issuers partner with luxury brands to offer unique experiences. For example, a premium card collaboration with a luxury watchmaker might allow cardholders to attend a private viewing of new timepieces.

Tech-Driven Enhancements: From AI-powered concierge services to digital wallets, technology is revolutionising the premium card experience. Imagine receiving personalised travel recommendations from an AI assistant based on your past preferences.

Focus on Sustainability: As awareness of environmental issues grows, premium cards incorporate sustainability initiatives. Some cards offer rewards for eco-friendly purchases or contribute to carbon offset programs. Imagine earning points every time you choose a green option, whether booking an electric car or dining at a sustainable restaurant.

Global Expansion: Premium cards are becoming more accessible globally, targeting new markets and demographics. Affluent millennials and digital nomads are now part of the premium cardholder community, enjoying perks that suit their dynamic lifestyles.

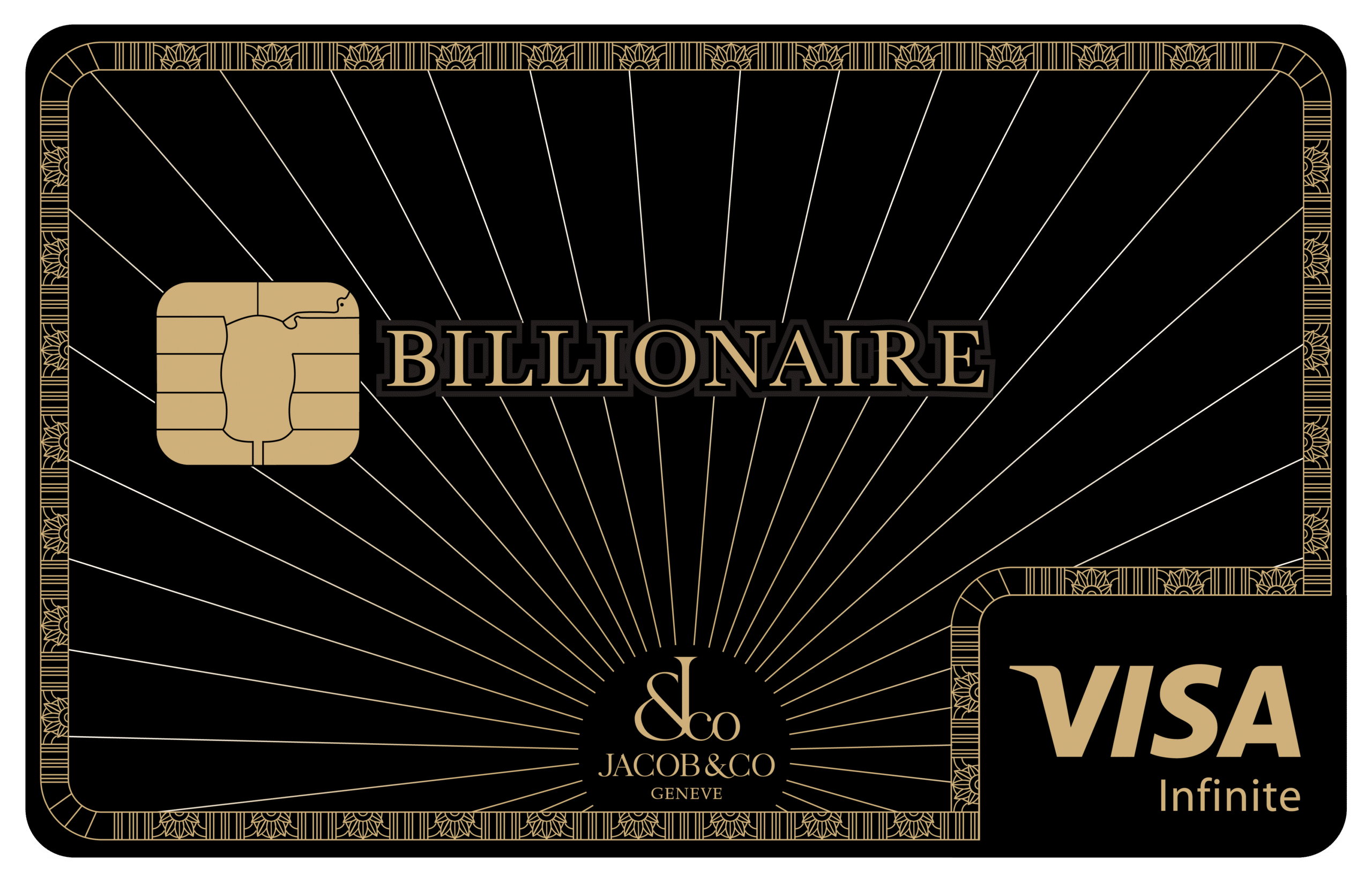

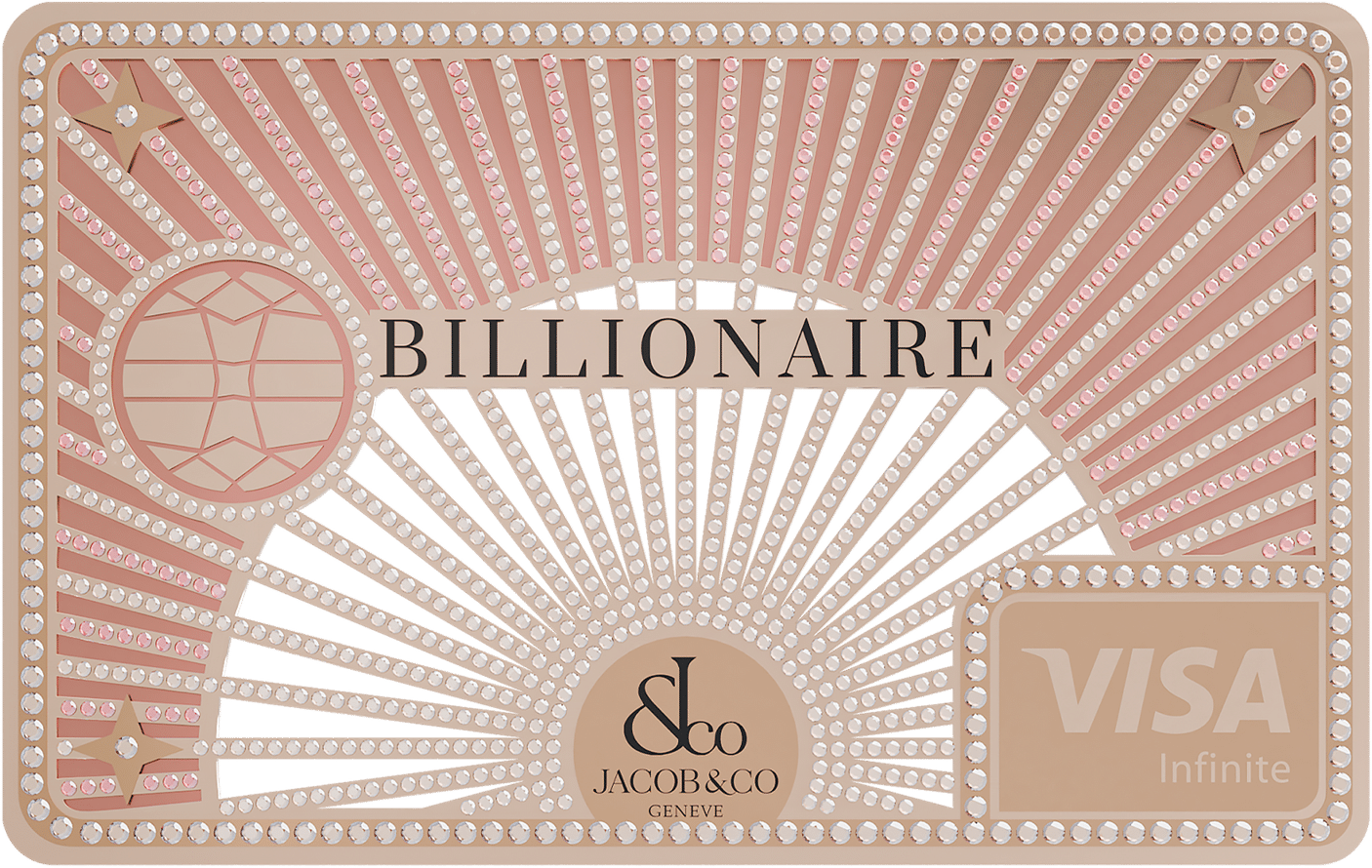

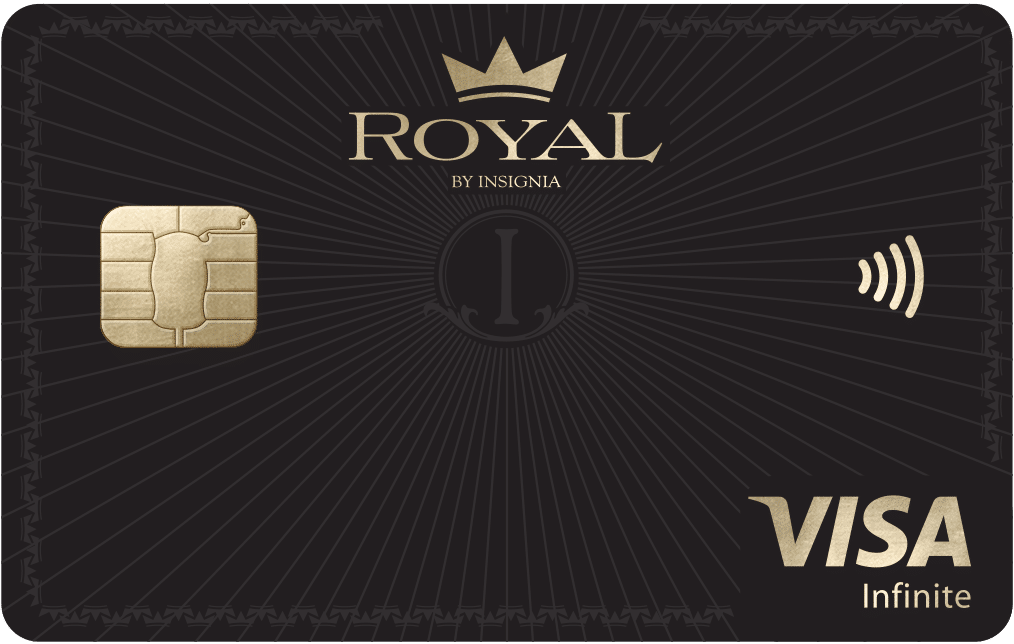

The Insignia Jewellery Card: For When a Black Card Doesn’t Cut It

Insignia has led the evolution of the premium payment card industry for nearly three decades. As pioneers, we introduced one of the first black cards, The Royal Card, in 2001, and it remains a symbol of prestige today. However, we have taken luxury to an unparalleled level with the Insignia Jewellery Card. More than just a payment card, it is a bespoke masterpiece designed for those who seek the ultimate in opulence and exclusivity.

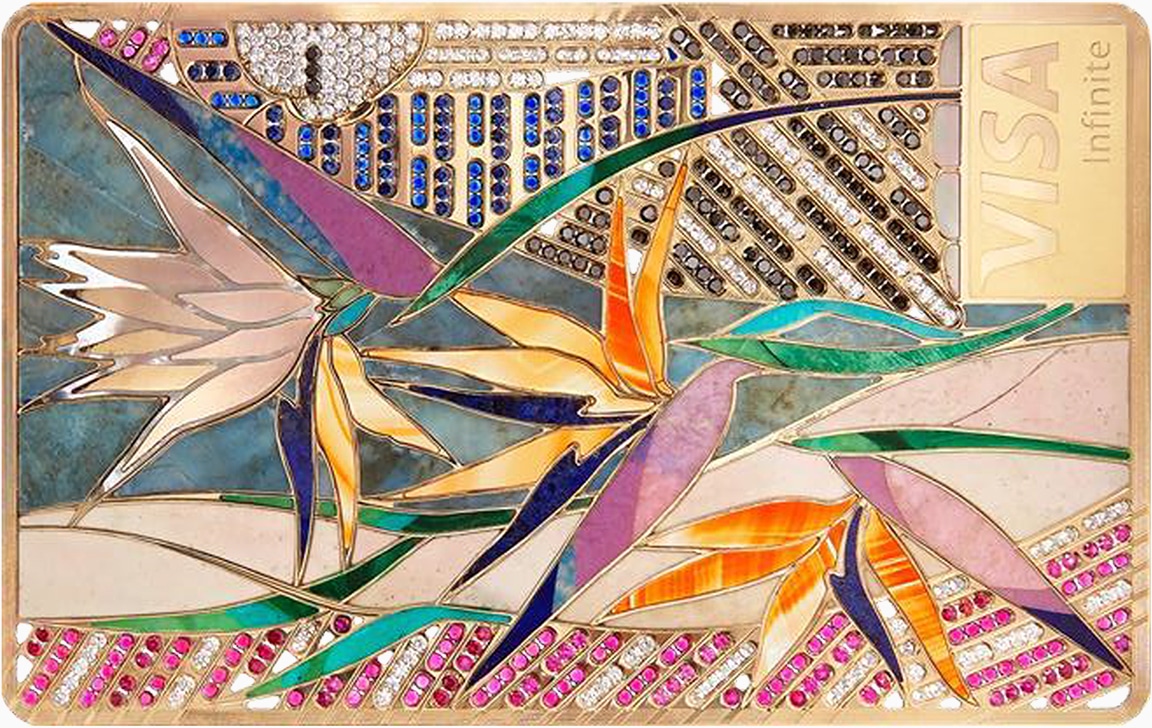

- Unique Design: Each Insignia Jewellery Card is a bespoke creation, allowing the cardholder to collaborate with master designers and jewellers to craft a truly unique card. From the initial concept to the final piece, clients can choose from a range of themes inspired by mythology, history, and nature. The design process is deeply personal, ensuring that the final product perfectly reflects the owner’s tastes and preferences.

- Exquisite Materials: Unlike traditional metal or plastic credit cards, the Insignia Jewellery Card is made from 14-carat gold and adorned with precious gems, such as diamonds and sapphires. The intricate craftsmanship involves embedding these stones into the gold structure, creating a card that is a financial tool and a piece of high jewellery. This blend of artistry and functionality sets the Insignia Jewellery Card apart from other premium cards.

- Personalised Collaboration: Cardholders work closely with skilled artisans and designers to create a unique card that reflects their identity and style. Whether it’s a monogram, a family crest, or a custom graphic, the card’s design can be tailored to incorporate personal symbols. This level of personalisation ensures that no two cards are alike, making each card a unique piece of art.

- Enhanced Privacy and Security: The Insignia Jewellery Card seamlessly integrates EMV technology into its design, ensuring secure transactions without compromising on aesthetics. The card omits magnetic stripes, embossed personal data, and CCV codes, enhancing both security and visual appeal.

- Financial and Lifestyle Benefits: Beyond its stunning appearance, the Insignia Jewellery Card offers many benefits. Cardholders enjoy 24/7 access to a dedicated personal assistant, a robust rewards programme, and exclusive access to private events and luxury experiences. Financial benefits include high spending limits, comprehensive travel insurance, and purchase protection, making it as practical as luxurious. Additional perks such as VIP airport assistance, preferential pricing on private aviation, and access to exclusive hotels and luxury services further elevate the cardholder’s experience.

The Insignia Jewellery Card is not just a payment card; it is a statement of individuality, a symbol of unmatched luxury, and an exclusive gateway to a world of bespoke experiences and elite services. For those who view a black card as merely the beginning, the Insignia Jewellery Card is the pinnacle of premium payment cards.