As the world continues to evolve and technology advances, the behaviours, and preferences of ultra-high-net-worth individuals (UHNWIs) are also shifting. In 2023, there are a few key trends expected to dominate.

One of the biggest trends among UHNWIs in 2023 is a focus on impact investing; this involves investing in companies, projects, and funds with a positive social or environmental impact rather than just focusing on financial returns. UHNWIs are becoming increasingly interested in using their wealth to make a difference in the world, and impact investing allows them to do that.

Another trend is a move towards sustainable and environmentally-friendly practices; this includes investing in renewable energy, reducing carbon emissions, and adopting sustainable business practices. Many UHNWIs are also looking to invest in companies working on innovative solutions to address climate change.

Another trend is the growing popularity of private equity and venture capital among UHNWIs; this type of investing involves buying stakes in private companies rather than publicly traded ones. UHNWIs are drawn to private equity and venture capital because of the potential for higher returns and the ability to have more control and influence over the companies in which they invest.

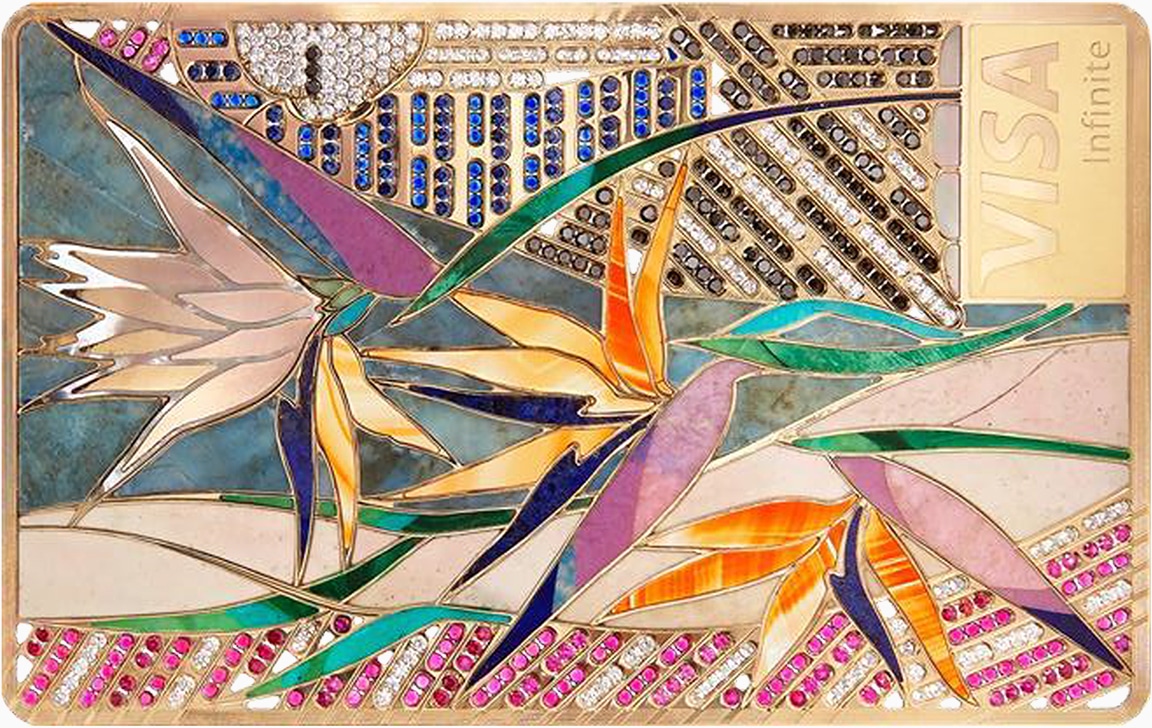

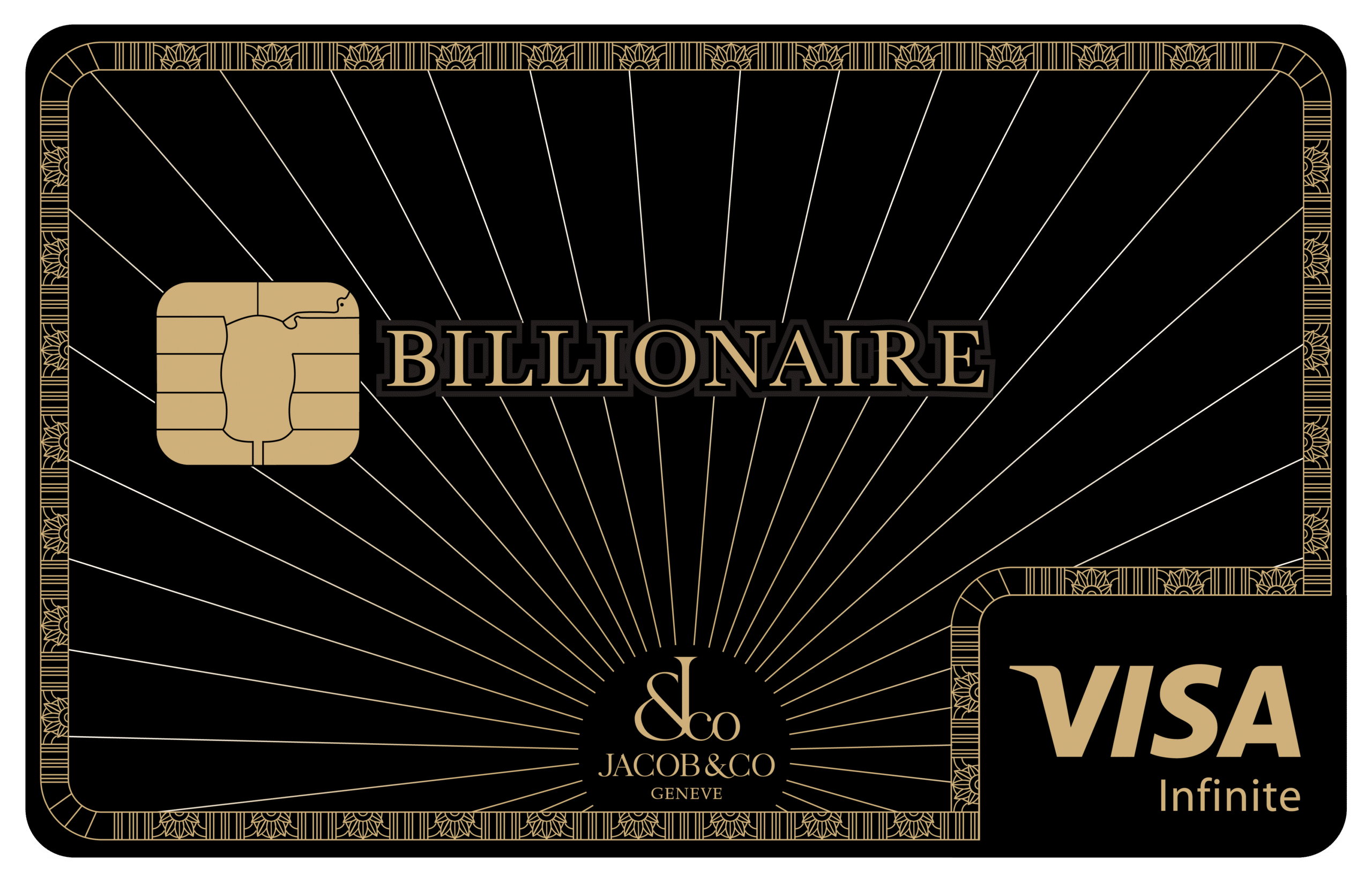

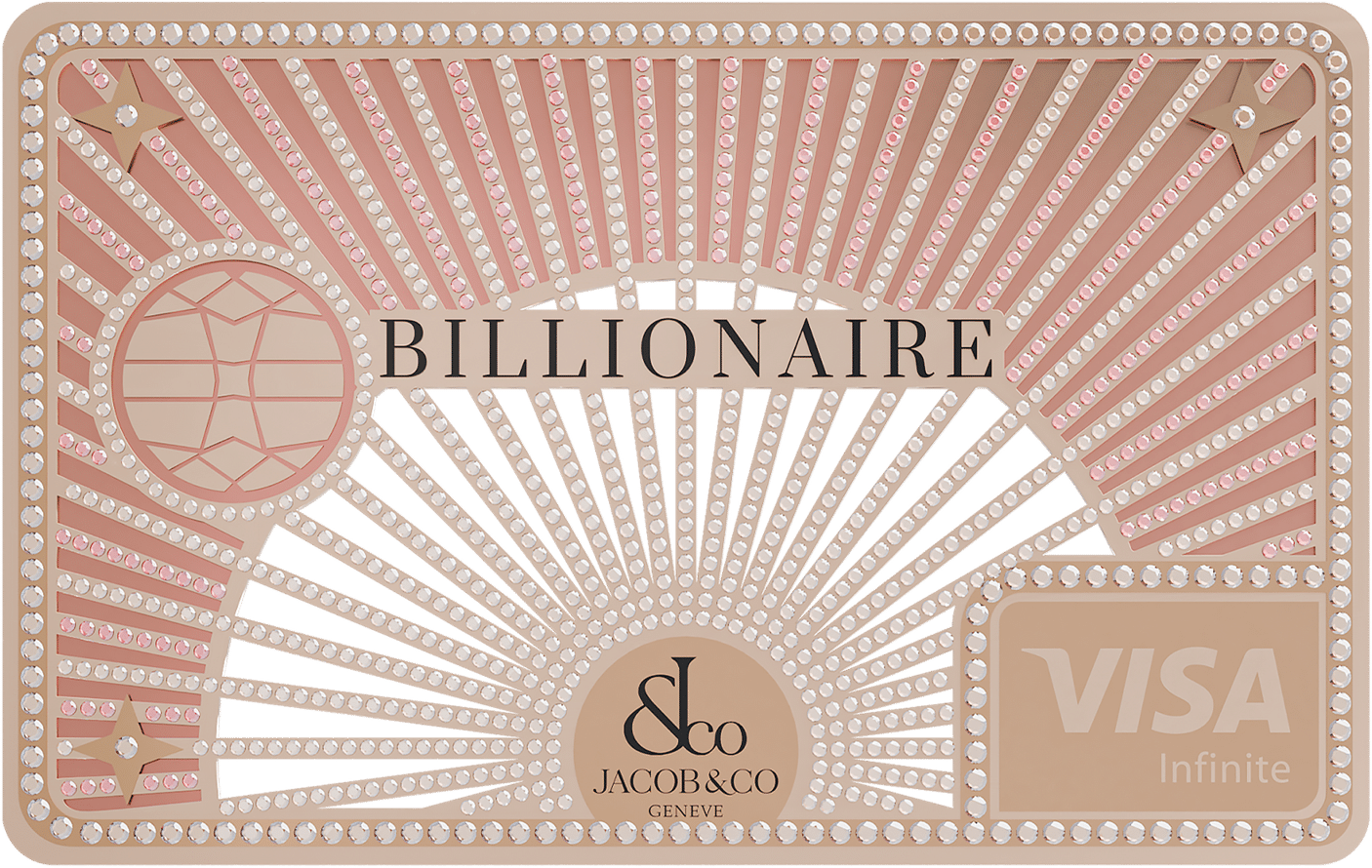

Experiential luxury lifestyle and travel and exclusive access to events, bespoke products and services remain high on the UHNWIs’ interests; it’s not all work without some play.

UHNWIs are also becoming increasingly interested in philanthropy and giving back. Many UHNWIs are using their wealth to support charitable causes and organisations that align with their values and interests, including making large donations, setting up foundations, or getting involved in philanthropy on a more hands-on level.

Finally, there is a growing trend among UHNWIs to seek out investment opportunities in emerging markets. These markets, such as China, India, and Africa, offer high growth potential and the opportunity to tap into new consumer markets.

In conclusion, the behaviours of UHNWIs are constantly changing and evolving, and the trends of 2023 indicate a shift towards impact investing, sustainable practices, private equity and venture capital, experiential luxury, philanthropy, and emerging markets.

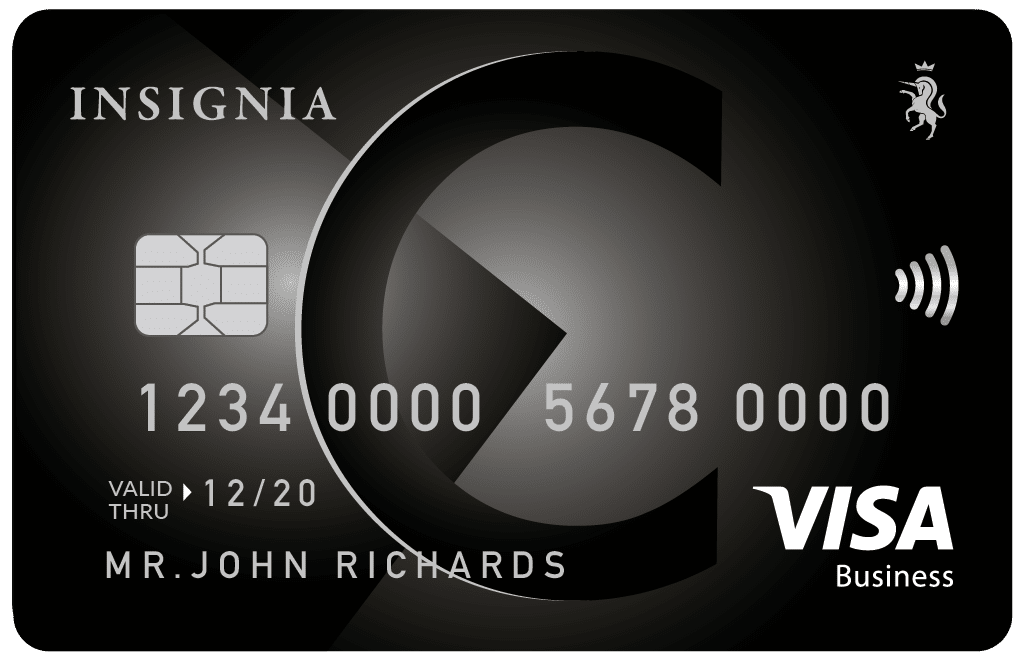

If you are an aspiring UHNWI, visit our cards section to consider applying for one of our premium payment cards.